Our software is now updated as per the latest GST changes. Take free demo now

Managing payroll is one of the most critical and challenging tasks for any business in India. With complex statutory obligations like PF, ESI, TDS, and changing labor laws, manual payroll processing is error-prone, time-consuming, and risky. That’s why a Payroll Management System (Payroll Software) is no longer a luxury — it’s essential for modern businesses.

In this blog, we will explore:

What is a Payroll Management System

Why Indian businesses need one

Key features to look for

Benefits of using payroll software

Popular payroll software options in India

How to choose the right payroll system

A Payroll Management System is software (or an integrated module in HR software) that automates all payroll-related tasks — from calculating salaries, deductions, and bonuses, to generating payslips, handling statutory compliance, and storing payroll records.

Rather than using Excel sheets or manual registers, businesses use payroll software to ensure accuracy, compliance, and efficiency.

There are several reasons why businesses in India should adopt a payroll management system:

Statutory Compliance: India has specific payroll-related laws — Provident Fund (PF), Employees’ State Insurance (ESI), Professional Tax (PT), TDS, etc. Payroll software helps automatically calculate these and generate statutory reports. clusterhr.com+2India Filings+2

Time & Cost Savings: Manual payroll processing is labor-intensive. Payroll software automates repetitive tasks, reducing the need for manual intervention. India Filings+1

Error Reduction: Automating calculations reduces human error in salary, deductions, and taxes. India Filings

Scalability: As your business grows, payroll needs grow. Payroll software can scale — adding more employees, handling different pay cycles, and more. tankhwapatra.com

Employee Self-Service: Many payroll systems have portals where employees can download payslips, view tax declarations, and check their salary history. tankhwapatra.com

Data Security: Payroll data is sensitive. Payroll systems provide encryption and permission control to protect this data. tankhwapatra.com+1

Real-time Reporting: You get instant reports on payroll costs, statutory contributions, and employee costs — which helps in better financial planning.

When evaluating payroll software for your business in India, here are some essential features to consider:

Statutory Compliance

Automatic PF, ESI, PT, TDS calculations

Generation of statutory reports (ECR, Form 24Q, 12BB, Form 16, etc.) clusterhr.com+1

Attendance and Leave Integration

Sync payroll with attendance/leave systems so that actual work hours are reflected in pay. clusterhr.com

Employee Self-Service Portal

Employees should view/download payslips, check their tax, and update certain details. factoHR+1

Flexible Salary Structure

Ability to create custom earnings/deduction components (bonus, arrears, overtime) using a formula-based engine. factoHR

Payslip Customisation

Customizable payslip formats and ability to generate in different languages. factoHR

Mobile Access

Mobile apps or mobile-friendly portals for both HR and employees. factoHR

Data Security

Encryption, role-based access, and secure cloud storage. tankhwapatra.com

Reporting & Analytics

Detailed payroll reports, cost analysis, and audit-ready statutory data. Saral Pro+1

Compliance Updates

The system should update automatically for changes in labor or tax laws. clusterhr.com

Multi-Company or Multi-Branch Support (if needed)

Handle payroll for different business units from a single system.

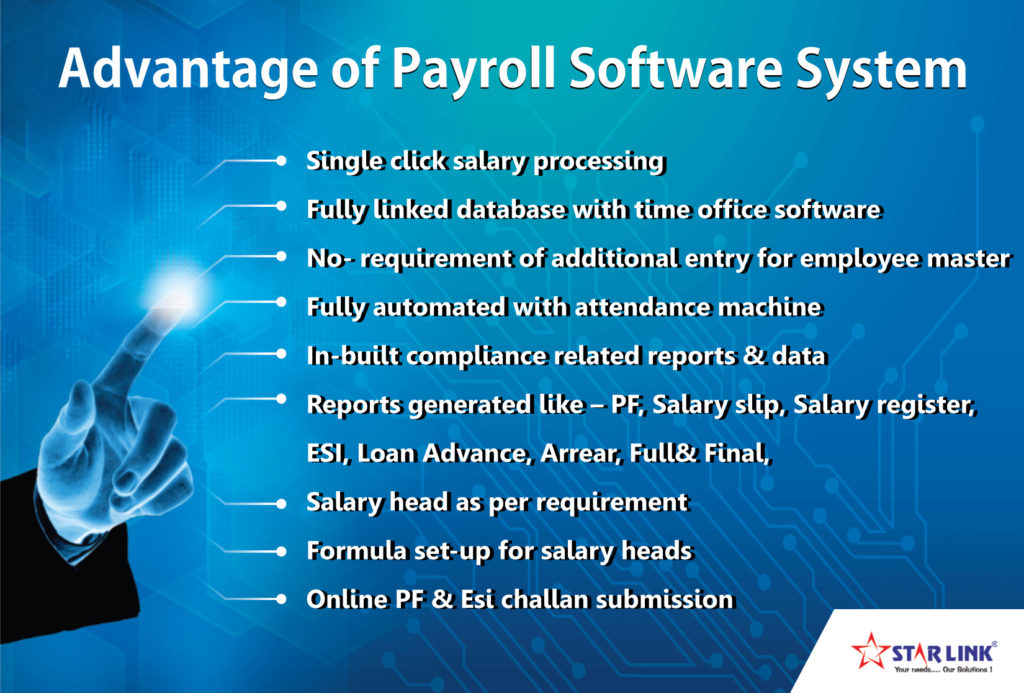

Implementing a payroll management system brings multiple advantages:

Efficiency: HR and finance teams save significant time, no more manual salary calculations.

Accuracy: Reduced risk of payroll errors and wrong calculations.

Compliance: Automated statutory deductions reduce the risk of legal penalties.

Transparency: Employees can check their payslips and tax documents.

Cost Savings: Less administrative overhead and fewer manual corrections.

Scalability: Software scales as business expands.

Security: Wage data and personal employee data are stored securely.

Here are some well-known payroll management systems widely used by businesses in India:

| Software | Why It’s Popular / Key Strengths |

|---|---|

| Keka HR | Cloud-based, integrates HR + payroll, good for mid-to-large companies. Keka HR+1 |

| factoHR | Flexible rule engine, employee self-service portal, strong payroll capabilities. factoHR |

| Zoho Payroll | Tight integration with Zoho ecosystem, easy TDS, tax deduction, and payslip generation. Zoho |

| Saral Pro Payroll | Excellent statutory compliance support (PF, TDS, PT), robust reporting. Saral Pro |

| PayMax | Indian-designed payroll application, multi-branch, generates salary slips & statutory reports. maxus.co.in |

| Nitso Payroll Specialist | Very flexible earnings/deduction setup, PF/ESI/Prof. Tax compliance, loan management, leave tracking. Nitso Technologies Pvt. Ltd. |

Here are some tips to help you pick the right payroll software for your company:

Gauge Your Needs

How many employees do you have?

Do you need attendance integration?

Do you need multi-branch payroll?

Compliance Support

Ensure the software handles Indian statutory rules (PF, ESI, TDS, etc.).

Check how often they update with legal changes.

Ease of Use

Try a demo.

Check if the software is user-friendly for both HR & employees.

Scalability

Choose a software that can grow with your business.

Avoid solutions that will become outdated as you expand.

Support & Training

Prefer a provider that offers good customer support.

Training for HR staff is important.

Cost

Compare subscription vs one-time cost.

Check for hidden costs (like report generation, payroll runs, or compliance).

AI & Automation: Automated payroll forecasting, anomaly detection in pay.

Mobile Payroll: Employees will increasingly use mobile apps to access payslips, tax forms, and declarations.

Embedded Compliance: Real-time updates for governments’ changing regulations will be automatic in payroll tools.

Integrations: Payroll systems will integrate even more deeply with attendance systems, HRMS, and ERP tools.

Global Payroll: Indian-based businesses expanding overseas will use payroll systems that support multi-country payroll.

A Payroll Management System is vital for any business in India today — especially to:

Automate salary calculations

Ensure compliance with labor & tax laws

Reduce errors and administrative burden

Provide transparency to employees

Improve HR efficiency

Scale business without scaling risk

With strong options like Keka, factoHR, Zoho Payroll, Saral Pro, PayMax, and Nitso, businesses of all sizes can find a payroll tool that fits their needs. Evaluate carefully based on feature set, compliance, ease of use, and cost — and you’ll be set up for payroll success in 2025.

© Copyright digifysoft 2025.